Generated Title: Stripe's Crypto Gambit: A Payment Revolution or Just Another Blockchain?

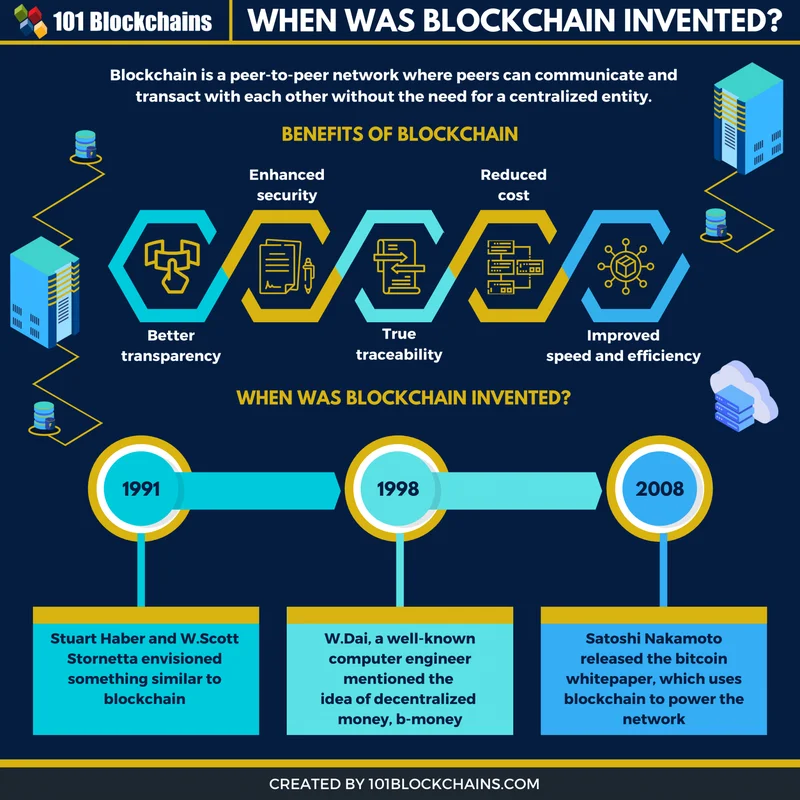

Stripe, the payments behemoth, is diving deeper into the crypto world with Tempo, a new layer-1 blockchain focused on stablecoins and payments. The claim is that Tempo will revolutionize how we handle online transactions. But is it truly a game-changer, or just the latest in a long line of ambitious blockchain projects?

Decoding the Tempo Promise

The headline numbers are impressive: 100,000 transactions per second (TPS), low fees, and features designed for real-world payments. They are even throwing around the concept of "agentic payments". Let's consider the TPS claim for a moment. Ethereum, a major player, manages around 22 TPS. Solana, often touted for speed, clocks in at roughly 1,344 TPS. If Tempo hits its mark, it would be a substantial leap forward. But, as always, the devil is in the details. What kind of transactions are they measuring? Are these simple transfers, or more complex smart contract interactions? The type of transaction drastically affects TPS.

Tempo aims to streamline global payouts, remittances, and microtransactions. The lure of tokenized deposits with 24/7 settlement is attractive, especially when compared to traditional banking systems that still operate on archaic schedules. They even managed to poach Dankrad Feist, a prominent Ethereum developer, to join the team. But it all hinges on adoption. A blockchain is only as valuable as the network of users and applications built upon it. And that's where Stripe's involvement becomes critical.

The Stripe Advantage?

Stripe brings more than just capital to the table. It brings a massive existing network of merchants and a deep understanding of the payments landscape. The firm raised a $500 million Series A, valuing it around $5 billion. That’s a sizable commitment, but it’s pocket change for Stripe, really. (Stripe was valued at $95 billion at one point).

The involvement of firms like OpenAI, Shopify, and Visa as design partners lends credibility. But design input is not the same as active integration. Will these companies truly embrace Tempo, or will it remain a side project? I've looked at hundreds of these partnerships, and often "design input" is just a fancy way of saying "we had a meeting."

Tempo's focus on stablecoins is smart. The stablecoin market cap has exploded, exceeding $300 billion. Treasury Secretary Bessent believes it could hit $2 trillion. That is a massive potential market, and Stripe is positioning itself to capture a piece of it.

One interesting aspect is the opt-in privacy feature. While blockchains are known for transparency, Tempo allows users to keep select transaction data private while complying with financial regulations. This could be a major selling point for businesses concerned about exposing sensitive financial information on a public ledger.

The Road Ahead

Tempo is currently in a private testnet phase, working with its design partners. What Is Tempo? The Payments and Stablecoin Blockchain Built by Stripe reports that the plan is to eventually transition to an open, permissionless network. This gradual approach makes sense, allowing them to iron out the kinks and build a solid foundation before opening the floodgates.

But the challenges are significant. Building a new layer-1 blockchain is no small feat. It requires solving complex technical challenges, attracting developers, and building a vibrant ecosystem. And they aren’t the only ones trying to solve this problem. What makes Tempo uniquely positioned to succeed where others have faltered? The answer, I suspect, lies in Stripe's ability to bridge the gap between the traditional financial world and the world of crypto.

Stripe's Ace in the Hole

The key here is the integration with existing payment rails. Stripe is already deeply embedded in the global financial system. If Tempo can seamlessly connect to these existing systems, it could offer a compelling alternative to traditional payment methods. This is what separates it from being "just another blockchain."

I keep coming back to the question of incentives. Will Stripe truly push its existing merchant base to adopt Tempo? Or will it remain a separate, experimental project? The answer to that question will determine Tempo's fate.

So, What's the Real Story?

Tempo has potential. Stripe's backing gives it a significant advantage. But potential doesn't equal guaranteed success. The blockchain landscape is littered with ambitious projects that failed to deliver. Ultimately, Tempo's success will depend on its ability to solve real-world payment problems and gain widespread adoption. The numbers, as always, will tell the true story.